The Association of American Railroads is your trusted source for comprehensive data and analysis on North American freight rail. Our expert economists offer a variety of statistical products, which are free for AAR members and are available for purchase by non-AAR members in our Online Catalog. In this Data Center you will find the Freight Rail Index, Rail Traffic and Rail Cost Indexes.

Helpful Links

- AAR Resources Page: Fact sheet PDFs, facts and figures and more.

- State Data: View the rail network map and download state fact sheets.

- Technical Publications Managed by MxV Rail: MxV Rail provides information on AAR interchange rules, open top loading rules, standards and recommended practices and other technical topics as well as a fee-based circular letter library. Email publications@aar.com for more information.

Reports

- Supply Chain Resilience: Shows that freight rail acts as a built-in stabilizer in the U.S. economy. Amid rising transportation costs and supply chain stress, rail’s efficiency, predictability, and resilience help buffer inflation and volatility.

- Rail Industry Overview (RIO): Free monthly publication that provides insights from our economists into what rail traffic says about today’s economy and where the data suggests it could be headed.

- Economic Impact Report: Quantifies rail transportation’s economic impact, finding that in 2023, railroads contributed $233.4 billion in total economic output.

- Jobs Report: Explores the benefits and opportunities of railroading and get insights straight from employees.

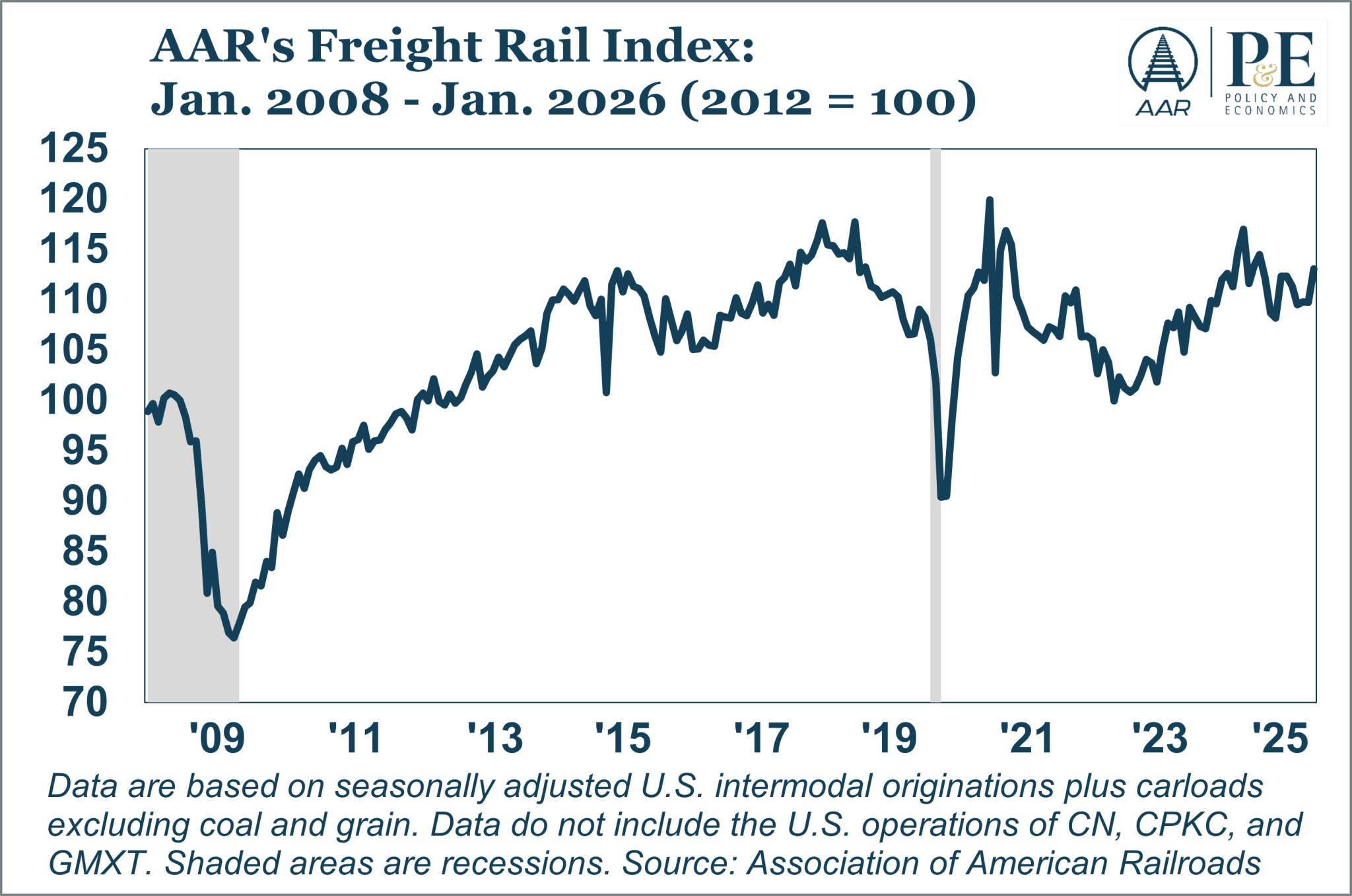

Freight Rail Index

The AAR’s Freight Rail Index (FRI) is defined as intermodal plus carloads excluding coal and grain. We exclude coal and grain because their carloads tend to rise or fall for reasons that have little to do with what’s going on in the broader economy. For most rail traffic categories, what’s going on in the broader economy absolutely matters, and that’s also why rail traffic is a useful gauge for overall economic conditions. We seasonally adjust the FRI to make it more relatable to other economic indicators. Explore the latest Rail Industry Overview report for more insights.

Weekly Rail Traffic

Email publications@aar.org for licensing information. Each week, North America’s major railroads submit their traffic data to the AAR, which is compiled and published in the Weekly Railroad Traffic report every Wednesday at noon. This data is also shared through a press release. The interactive chart below highlights weekly rail traffic trends over recent years. For more detailed information, you can explore the full Weekly Railroad Traffic report. Carload traffic is categorized into 20 major commodity groups, while intermodal traffic — comprising shipping containers and truck trailers moved by rail — is reported separately.

Major rail traffic groups and associated weekly railroad traffic commodity categories include: Chemicals; Coal; Farm Products (excluding grain, grain mill products, and food); Forest Products (primary forest products, lumber and wood, pulp and paper); Grain; Metallic Ores & Metals (coke, primary metal products, iron and steel scrap); Motor Vehicles & Parts; Nonmetallic Minerals (crushed stone, sand and gravel, nonmetallic minerals, stone, clay and glass); Petroleum & Petroleum Products; Other (waste and nonferrous scrap, all other carloads)

Quarterly Rail Traffic

The chart below shows quarterly rail traffic trends for the past few years created by averaging weekly rail traffic data. More detail is available in the AAR’s Rail Time Indicators Report (RTI). In addition to a vast amount of data on U.S. and Canadian rail traffic, RTI includes more than 15 key economic indicators such as consumer confidence, housing starts, and industrial production. RTI combines all of this information in a single place, highlighting key trends and presenting rail traffic data in the context of specific sectors and the broader economy.

Annual Rail Traffic

Each year, the six U.S. Class I railroads—BNSF, CN (GTC), CPKC, CSX, NS, and UP—provide AAR rail traffic data with far more commodity detail than the weekly or monthly traffic data discussed above. The chart above provides 10-year trends for some major rail commodities based on this alternative source of rail traffic data. Additional commodity detail is available in the AAR’s Freight Commodity Statistics report.

Rail Cost Indexes

Rail Cost Indexes is a quarterly publication which features the regional and U.S. Railroad Cost Recovery Index (RCR). It also includes a summary and history of the All-Inclusive Index (AII-LF) and the Rail Cost Adjustment Factor (RCAF). All indexes are meant to measure changes in the prices for inputs to railroad operations such as wage rates, fuel prices, materials prices, and others. For some of the index components, small narratives are provided that explain causes of the latest changes. Subscriptions are for the calendar year.

Rail Cost Adjustment Factor (RCAF)

The RCAF was established in response to the requirement in the Staggers Rail Act of 1980 that a quarterly cost-recovery index be created. Each quarter, the AAR submits the RCAF index to the Surface Transportation Board for approval. (Includes the RCAF-U and RCAF-A). Q126 (Submission / Decision). Find older submissions and decisions at the bottom of this page.

All-Inclusive Index Less Fuel (AII-LF)

Provides a parallel measure of the RCAF without the influence of the fuel cost component. All of the components (Labor, M&S, etc.) used in the AII-LF match those of the All-Inclusive Index used to calculate the RCAF. A forecast error adjustment to the AII-LF is also calculated using the same methodology applied in the RCAF.

Index of Monthly Railroad Fuel Prices (MRF)

This index is a component of both the RCR and RCAF and measures changes in the price of locomotive diesel fuel purchased by freight railroads.

Railroad Cost Recovery Index (RCR)

The RCR is a price index that measures changes in the price level of inputs to railroad operations: labor, fuel, materials and supplies, and other operating expenses (Full Description). The RCR, which has been produced in its current form since 1977, is published quarterly in the AAR Railroad Cost Indexes. This publication contains both quarterly and annual versions of the RCR for the United States and the east and west regions. In addition, AAR Railroad Cost Indexes contain other railroad-related indexes such as the All-Inclusive Index and the RCAF.

Older RCAF Documents

2025

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2024

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2023

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2022

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2021

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2020

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)

- Q1 (Decision / Submission)

2019

- Q4 (Decision / Submission)

- Q3 (Decision / Submission)

- Q2 (Decision / Submission)