Key Takeaway: Railroads play a vital role in sustaining America’s economy by implementing strategic measures to maintain a consistent flow of freight within the complex global supply chain. By expanding network capacity, growing the workforce and fostering strong partnerships throughout the supply chain, railroads enable the efficient movement of goods across the country and worldwide.

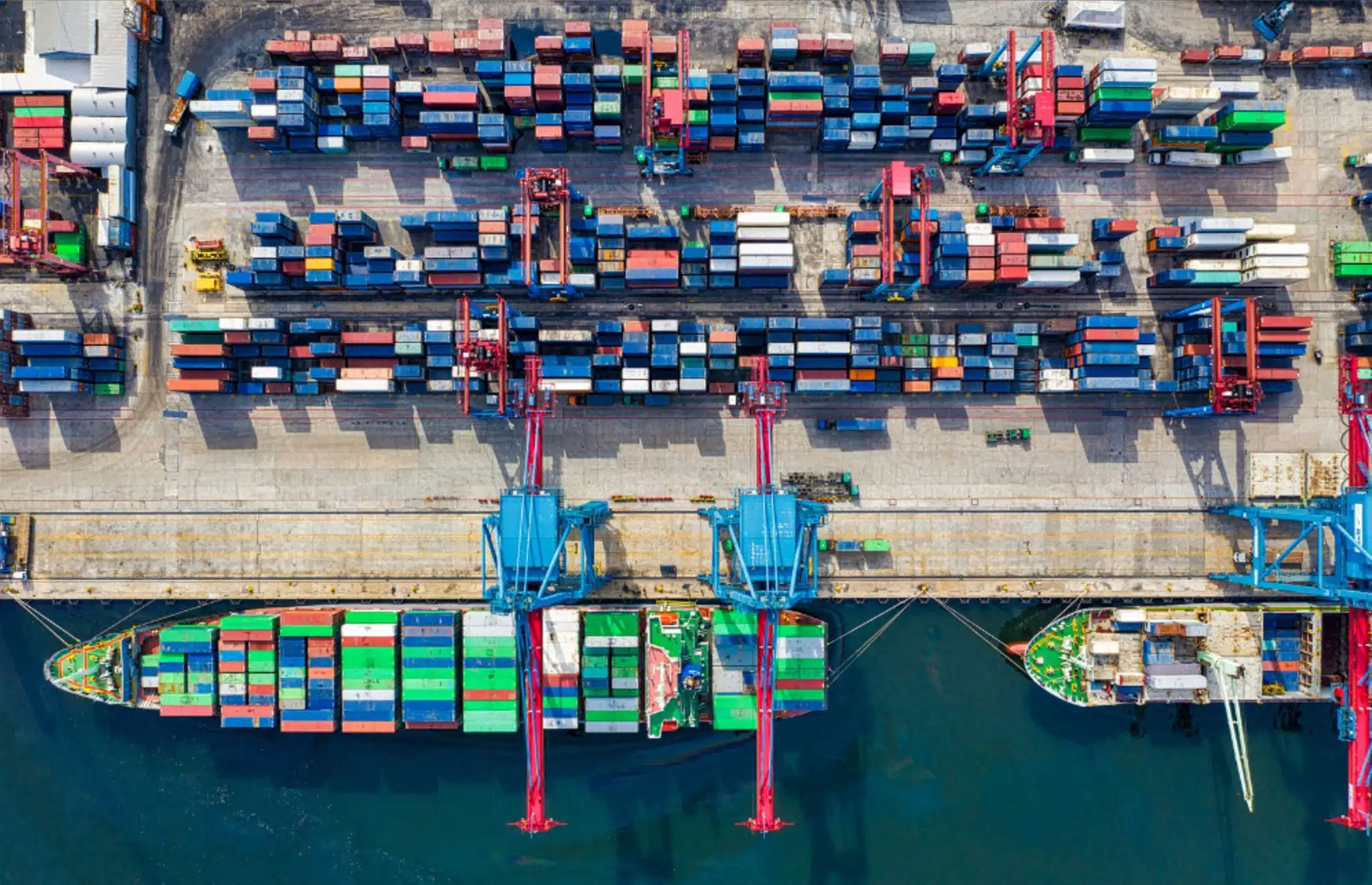

The global supply chain is a complex web of steamship lines, trucks, railroads, ports, and many providers, from drayage and truck chassis to shipping containers and warehouses. Given their economy of size, unparalleled fuel efficiency and ongoing network investments, freight railroads are critical to keeping the transportation network flowing efficiently. Railroads are always ready to solve supply chain challenges, improve customer service and proactively plan for the future.

Railroads are the most fuel-efficient way to move freight over land, excelling in reliability, sustainability and cost-effectiveness for moving large volumes across vast distances. They serve as a crucial component of intermodal transportation, seamlessly connecting with trucks and barges to facilitate the movement of goods domestically and internationally.

Through these partnerships, railroads play a pivotal role in linking businesses worldwide, enhancing America’s competitiveness. By collaborating with trucks and barges, trains transport an average of 61 tons of freight per person annually, facilitating the movement of goods across the globe.

Freight railroads reinvest billions of dollars in annual investments to strengthen and optimize their private networks. These investments enhance the efficiency, dependability, safety, and sustainability of their infrastructure and equipment and the broader transportation supply chain. Railroads also work closely with shippers, suppliers, and industry stakeholders to mitigate bottlenecks and minimize delays.

Infrastructure & Equipment: Upgraded tracks, bridges and tunnels bolster safety and reliability while specialized rolling stock, such as high-capacity freight cars and intermodal containers, maximize cargo per trip.

Technology: GPS tracking, real-time sensors, and data analytics provide train location updates, cargo status insights and preemptive maintenance alerts, which keep small problems from becoming bigger ones.

Intermodal: Substantial investments in new intermodal facilities, and modernizing existing ones, have been focal points in recent years, leading to reduced transit times and overall cost reduction.

Network: Network expansion through additional tracks, sidings, and rail lines has augmented freight volume handling capacities, curbing congestion and curtailing delays.

Given the interconnected nature of supply chains, multiple forces can influence their future. For example, the COVID-19 pandemic and resulting prolonged shutdowns in China, changing consumer purchasing trends, soaring container shipping rates, geopolitical uncertainty and increasing tariffs have all caused businesses to optimize their operations for efficiency, cost-effectiveness, and sustainability.

In this ever-shifting global landscape, railroads nimbly adapt to evolving traffic patterns and customer needs through technology, tailored shipping solutions and strategic investments. Below are a few examples.

Nearshoring Pioneers

An emerging trend toward “nearshoring,” involving the relocation of production facilities closer to target markets, is quickly gaining speed. This approach reduces lead times, lowers transportation costs, bolsters quality controls, and diminishes supply chain risks by reducing reliance on distant suppliers. The migration of U.S. operations or production to Mexico, a stronghold of auto manufacturing, stands emblematic of this trend.

The Trade Office indicates that a key driver in trade growth is the automotive industry and that freight rail moves seven out of 10 cars produced in Mexico, while a decade ago, it was only three out of 10. The Federal Reserve Bank of Chicago estimates that “about 80-85% of motor vehicles assembled in Mexico and destined for the United States and Canada are transported by rail.” As a heavy hauler of autos, railroads are meeting customer needs in Mexico.

Renewable Energy Surge

By facilitating the transportation of renewable energy components like wind turbine parts and solar panels, railroads contribute significantly to the growing renewable energy sector. Additionally, the safe and efficient transportation of natural gas and other energy resources complements the expansion of the natural gas sector. Noteworthy strides in energy-efficient practices and adopting cleaner locomotives reflect railroads’ dedication to reducing carbon emissions and championing energy sustainability.

Shifting Chemical Markets

Since the mid-2000s, the United States has been experiencing a revolution in shale energy production, which involves the extraction of oil and natural gas from shale rock formations to create energy, chemicals and petrochemicals. The development of more shale-advantaged plants is just one reason the chemical market has grown, with U.S. plastics production alone rising over the past five years because of those new plants. To support this growth, railroads have invested in hazmat routing software, tank car enhancements and network expansion efforts, including upgrading rail lines and expanding rail yards.

Intermodal Revolution

The rising adoption of e-commerce has increased the demand for versatile and reliable transportation solutions like intermodal transport. Railroads have invested heavily in intermodal through upgrading terminals, building new complexes and integrating lower-emission technology into intermodal operations, including zero-emission cranes and anti-idling locomotives.