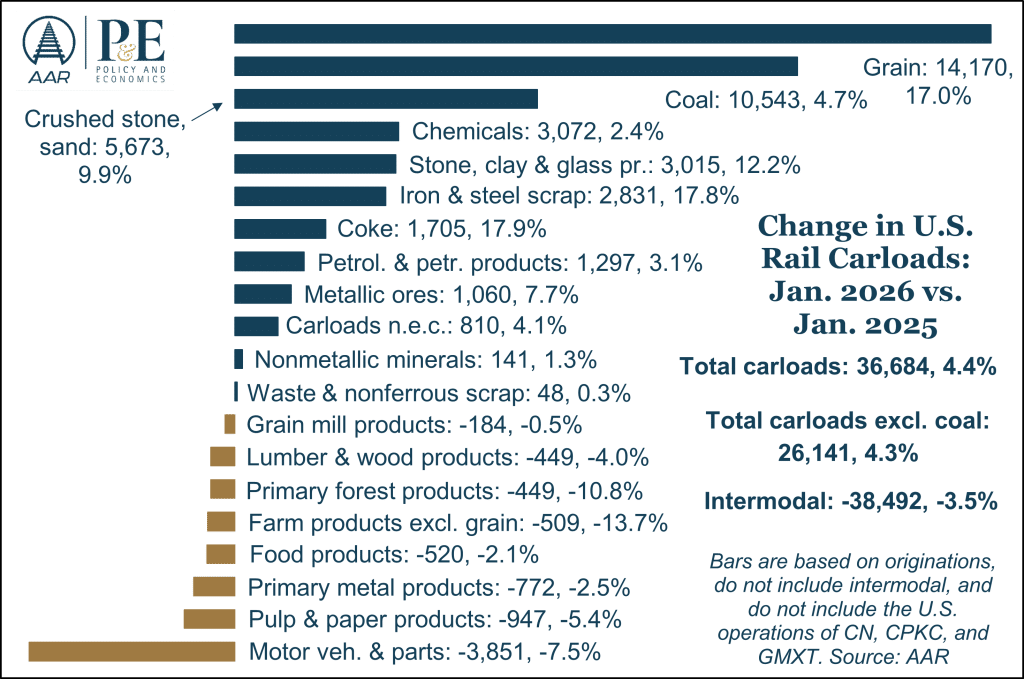

RIO is a free monthly publication that provides insights from our economists into what rail traffic says about today’s economy and where the data suggests it could be headed. As part of RIO, the Freight Rail Index (FRI) tracks movement across the most economically sensitive rail traffic commodities.

You can find the full report each month on this webpage, with past editions available as PDFs at the bottom of the page. You can sign up for our email newsletter above to have RIO delivered directly to your inbox. For a deeper analysis, subscribe to our Rail Time Indicators (RTI) report.

Find past edition PDFs at the bottom of this page.

February 2026 Key Takeaways

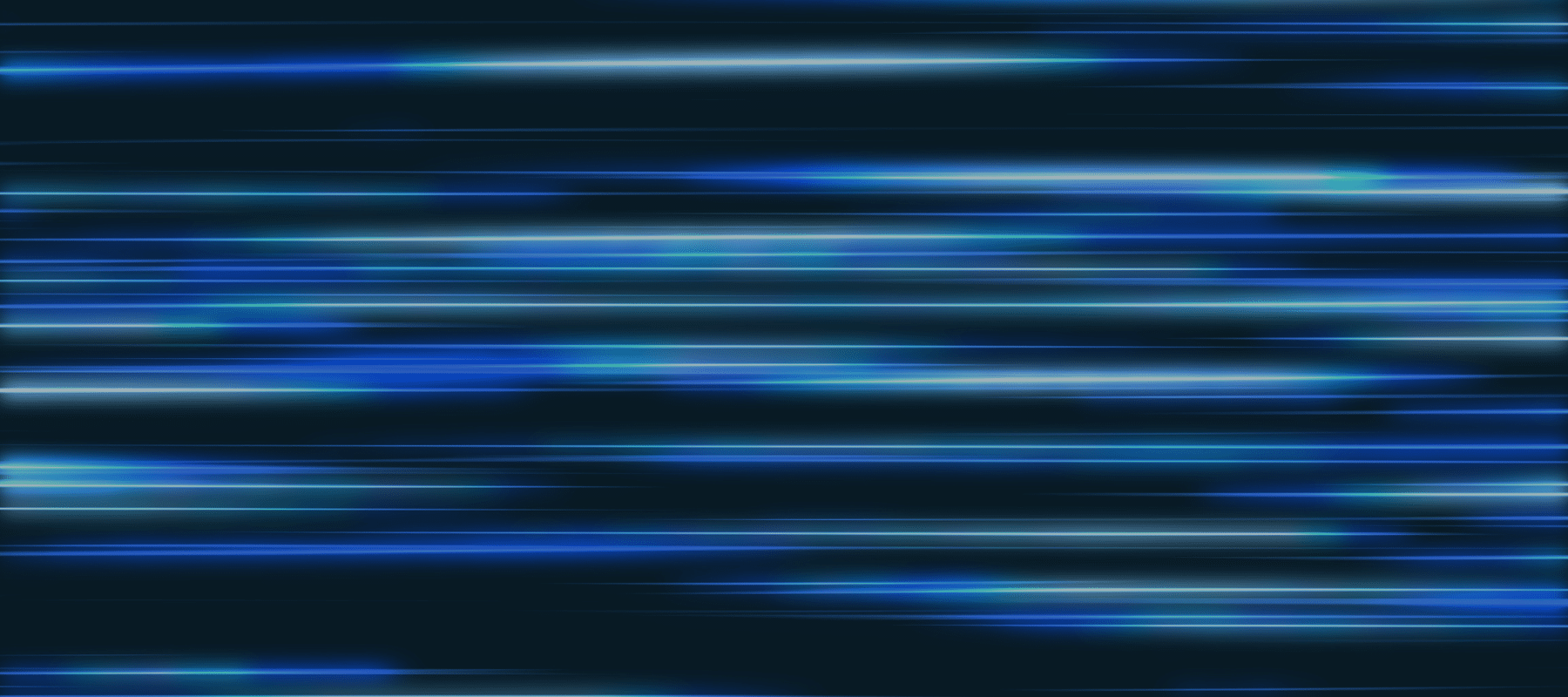

- Carload Rebound. January carloads rose 4.4% year-over-year, with gains in grain, coal, and other industrial products outweighing declines in automotive shipments.

- Intermodal Softening. U.S. rail intermodal volume fell 3.5% in January, the fifth consecutive year-over-year decline for intermodal.

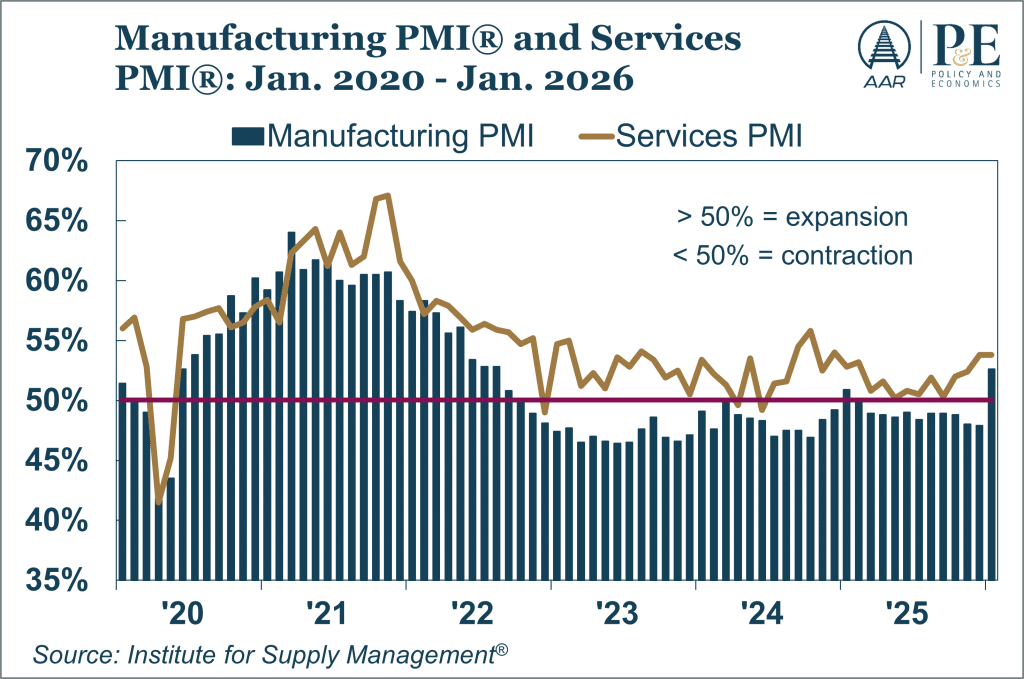

- Hope for Manufacturing. The Manufacturing PMI® climbed above 50% in January, its highest reading in more than 3 years and a potential early sign of a manufacturing rebound.

- Economic Backdrop. Looking ahead, a recovery in manufacturing, continued resiliency for consumer spending, and easing trade tensions would support rail volume growth, while persistent inflation, a weakening labor market, high interest rates, and uncertain global trade policy could weigh on demand.

An Uneven Backdrop

For the economy, uncertainty continues to be a defining feature. The most recent GDP figure — 4.4% in Q3 2025 over Q2 2025 — was strong, but few forecasters view that pace as sustainable.

It’s not hard to find economic indicators that are worrisome. Consumer confidence recently fell to an almost 12-year low. So far, consumer spending has held on, suggesting households are pushing past sentiment concerns, but the durability of that support remains uncertain. Housing is subdued, auto sales have softened, and industrial production has been largely flat for several years. January’s big jump in the Manufacturing PMI to 52.6% was encouraging, but whether that marks a sustained turn or a short‑lived bounce is unknown.

On the other hand, several fundamentals help explain why many economists still expect growth in the 2% –2.5% range this year. The labor market, while cooling, continues to generate income growth, while inflation has eased enough to support real purchasing power. Household balance sheets remain relatively healthy; service‑sector activity is holding up; and financial conditions have not tightened to recessionary levels. If GDP growth persists, it will likely be because consumer spending continues to carry the expansion, employment avoids a sharp downturn, and manufacturing weakness does not deepen. These conditions are far from guaranteed but are not implausible.

For railroads, this uneven backdrop points to a cautious outlook. Freight demand will hinge on, among other things, whether manufacturing momentum can be sustained, how trade policy evolves, and what unfolds in the labor market — all areas with significant open questions.

Carloads Grow, Intermodal Falls

A severe winter storm disrupted rail operations in much of the country the last week of January, but U.S. rail volumes have remained resilient.

Total U.S. carloads rose 4.4% in January 2026 over January 2025, with 12 of the 20 major AAR-tracked carload categories posting gains, led by grain, coal, and industrial-related products. Meanwhile, U.S. rail intermodal shipments fell 3.5% in January, their fifth straight year‑over‑year decrease as weaker port activity, softer goods demand, and ample trucking capacity continued to weigh on intermodal volumes.

Key Rail Commodities

Freight Rail Index

The AAR Freight Rail Index (FRI), which tracks seasonally adjusted intermodal shipments and carloads excluding coal and grain, is a useful gauge of economy-sensitive rail volumes. The index rose 3.1% in January 2026 over December 2025, thanks mainly to an uptick in carload traffic.

Coal

In January 2026, coal carloads were up more than 10,500 carloads, or 4.7%, over January 2025. This is the biggest monthly percentage gain since May 2025; year-over-year volumes have risen in 8 of the last 11 months. Long‑term U.S. coal use has been trending down, but several short‑term economic, weather, and policy factors have pushed coal consumption and production upward in 2025 and into early 2026.

Carloads Excluding Coal

U.S. carloads excluding coal rose 4.3% in January 2026, their 21st year-over-year gain in the past 24 months. Most of the gains have been modest — 4.3% is on the high end — because of sluggish underlying industrial and manufacturing activity.

Grain

U.S. grain carloads averaged 24,355 per week in January 2026, the most since April 2021 and up 17.0% over January 2025. One of the world’s largest grain exporters, the U.S. relies on global demand, competitive pricing, and efficient rail networks to maintain its export position. Higher grain carloads in 2025 were largely driven by higher grain exports. Likewise, how grain carloads perform in 2026 will be driven largely by U.S. grain export volume. As rail’s third-largest carload category (behind coal and chemicals), grain will play a key role in shaping overall rail volume growth in 2026.

Chemicals

Chemical carloads rose 2.4% in January 2026 over January 2025, their first year-over-year gains after two monthly declines. 2025 was a record year for chemical carloads; January’s results signal a solid start to 2026. The outlook for continued growth will depend in part on how effectively the chemical industry navigates a still-soft housing market and auto demand challenges. Stronger industrial production (like plastics) and lower natural gas prices would help support rail chemical volumes.

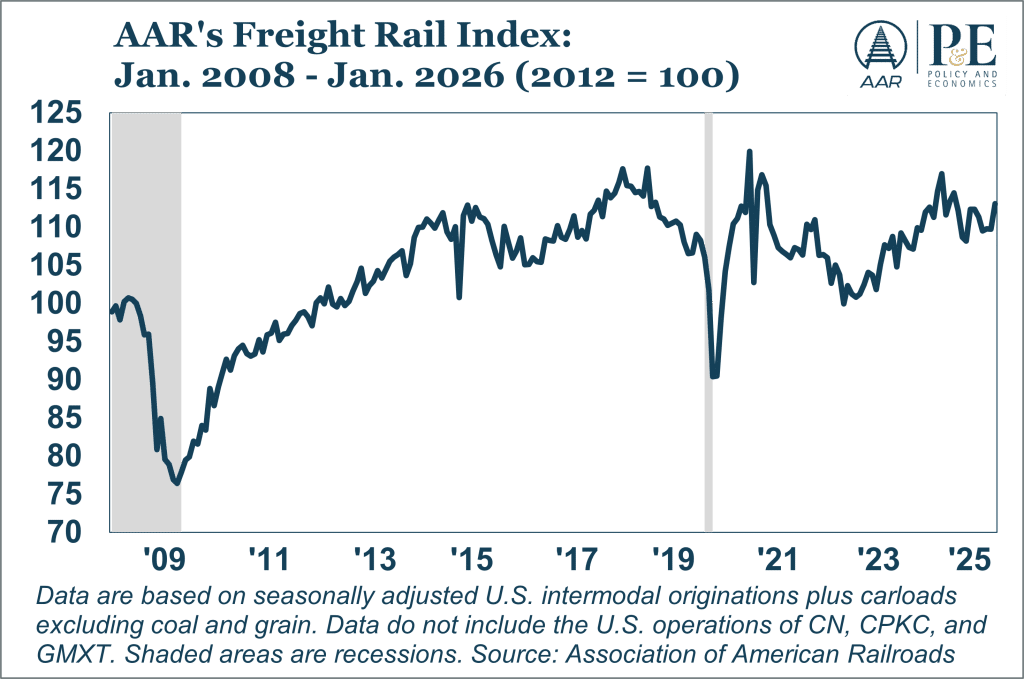

Steel-Related Products

Steel-related products are key rail sectors, consisting of three distinct categories: steel products, iron and steel scrap, and metallic ores (which are overwhelmingly iron ore). In January, U.S. carloads of primary metal products (mainly steel) fell 2.5%, just their second year-over-year decline in 11 months. U.S. carloads of iron and steel scrap surged 17.8% in January, their 11th straight solid gain. However, North American carloads of metallic ores (we use North American here because Canadian railroads carry large amounts of iron ore) fell 2.6% in January, their 20th consecutive year-over-year decline.

The sharp divergence between growing iron and steel scrap carloads and falling metallic ore carloads reflects continued cyclical and structural shifts in steelmaking. Domestic steel production has long been tilting toward electric‑arc furnaces, which use scrap rather than ore and can support rail movements even in a low‑growth manufacturing environment. Scrap is also domestically generated and rail‑friendly, while metallic ores are more exposed to blast‑furnace utilization (which has softened) and can bypass rail altogether via water-based supply chains. Together, these forces help explain why scrap volumes have strengthened even as ore traffic has weakened over the past couple of years.

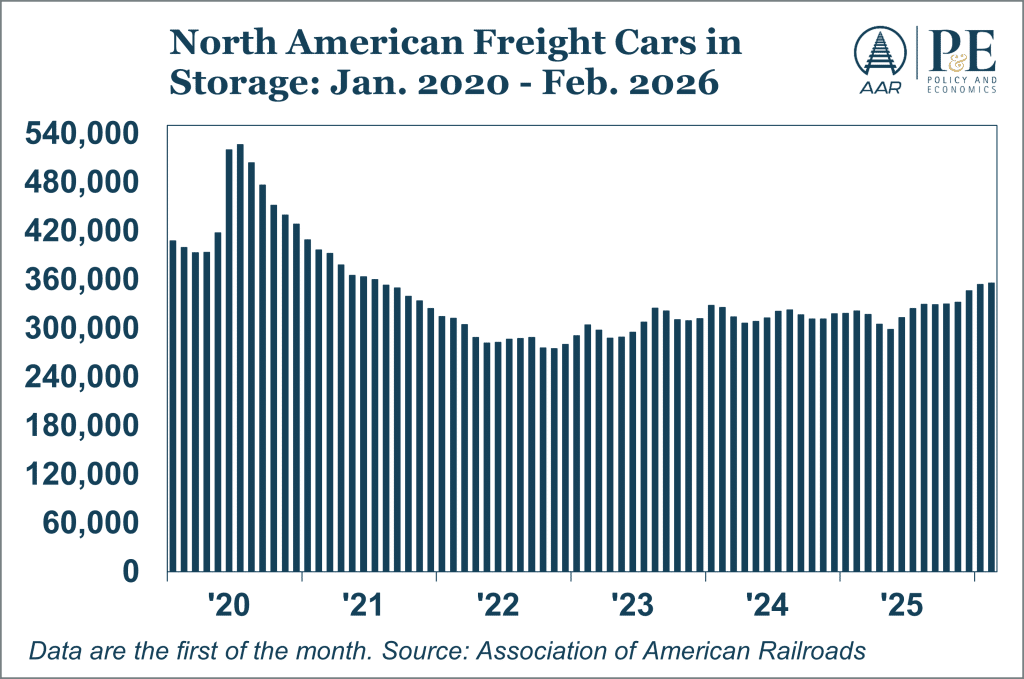

Slow Increase in Railcars in Storage

A railcar is considered in storage if it has not moved while loaded in the past 60 days and has only moved empty since its last loaded trip. Changes in the number of stored railcars are a real-time indicator of rail transportation demand and, by extension, broader economic activity. As of February 1, 2026, some 356,000 railcars — 21.8% of the 1.63 million North American freight car fleet — were in storage. The number of cars in storage has been slowly growing since mid-2025.

Uncertainty Will Likely Persist for a While

The Fed Leaves Interest Rates Alone

At its January 27–28 meeting, the Federal Reserve voted to leave interest rates at 3.5%–3.75%. This decision follows three straight quarter-point cuts late last year. Fed officials believe rates are now close to neutral (that is, neither actively stimulating nor restraining the economy) and appropriate given the balance of risks. In explaining its decision to adopt a wait-and-see, data-dependent approach, the Fed cited solid current economic growth, signs that labor market conditions are stabilizing, and inflation that remains “somewhat elevated” but is no longer deteriorating.

Barring a sudden change in economic conditions, the Fed seems likely to wait a while before cutting rates again while it evaluates progress against inflation and the staying power of economic growth. For freight railroads, this environment suggests traffic growth tied more to broader trends in industrial activity and consumer spending rather than changes in monetary policy.

Hope for Manufacturing?

The Manufacturing PMI®, a well-respected gauge of manufacturing health produced by the Institute for Supply Management®, unexpectedly rose to 52.6% in January, up from 47.9% in December and its highest level in 41 months. It’s only the third time in the past 39 months it’s been at or above 50%, the dividing line between contraction and expansion. The new orders sub-index surged from 47.4% in December to 57.1% in January, its highest level in nearly 4 years; the production sub-index was 55.9% in January, up from 50.7% in December. The ISM said January’s figure is encouraging but should be viewed cautiously, since January often reflects post‑holiday restocking and some purchases may have been pulled forward in anticipation of future challenges.

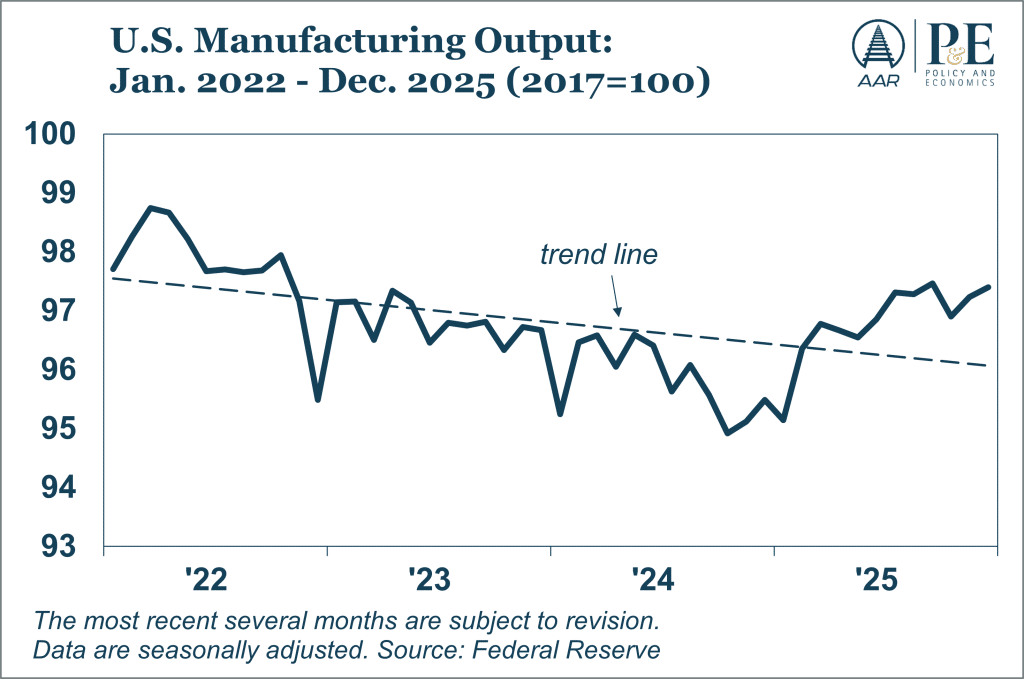

Meanwhile, Federal Reserve data show manufacturing output rose slightly in the second half of 2025, but the trend over the past several years has been slowly down. The hope, of course, is that January’s Manufacturing PMI® will be the start of a sustained turnaround that manifests itself in sustained gains in output. Time will tell, but until that happens, rail volumes will remain constrained.

Services Keep Expanding

The overall U.S. economy can grow even if manufacturing is contracting, as the past few years have shown. Not so with services: because services account for roughly three‑quarters of U.S. GDP, even flat services output puts a low ceiling on overall growth. That’s why it’s good news that the ISM’s Services PMI® (like the Manufacturing PMI® except it covers services) was 53.8% in January, matching its highest level in a year. As we’ve noted before, railroads are more directly impacted by the goods/manufacturing side of the economy, but strength in services supports rail demand indirectly by sustaining incomes, construction, and goods consumption.

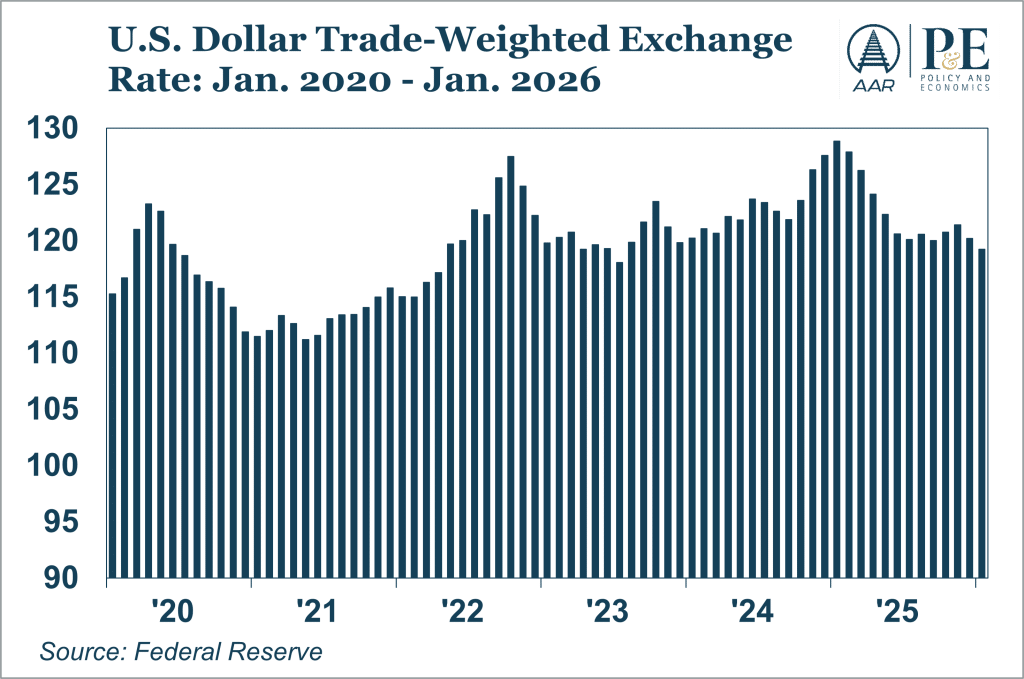

Weaker Dollar

Over the past year, the U.S. dollar has fallen materially against a trade-weighted basket of major currencies. Fed interest rate cuts have reduced the dollar’s interest-rate advantage relative to some major countries. Trade policy uncertainty continues. And longer-standing concerns — including large, persistent federal budget deficits, geopolitical tensions, and a gradual effort by some countries to reduce reliance on the dollar in trade and reserves — have added downward pressure on the dollar. For freight railroads, a weaker dollar could provide a modest tailwind. All else equal, a weaker dollar means U.S. exports are less expensive abroad. This could support higher outbound volumes of commodities such as grain and coal. On the other hand, a weaker dollar means U.S. imports are more expensive, a potential headwind for imports of consumer goods and other products carried by rail.

Continued Uncertainty in the Labor Market

The recent short partial government shutdown has caused a delay in the release of the employment situation report — it’s now scheduled to be released on February 11 instead of February 6. We won’t know January’s job gains and unemployment rate until then.

However, other recent labor-related indicators point to continued uncertainty. The “quits rate” measures the share of employed workers who voluntarily leave their jobs in a given period. Higher quits typically signal worker confidence and abundant job opportunities. In December (the most recent data point available), the quits rate was 2.0%, where it was for most of 2025. Job openings at the end of December were an estimated 6.54 million, the fewest since September 2020. Initial claims for unemployment insurance averaged 208,000 per week in January 2026, the fewest for any month since January 2024, while the hiring rate in December — the number of hires divided by total employed — was little changed from where it has been for the past several months, though that level is well below where it’s been for most of the past several years. For railroads, these mixed labor‑market signals suggest limited near‑term acceleration in freight demand tied to broad‑based employment growth.

Positioning for Incremental Growth Amid Mixed Signals

Looking ahead to the remainder of 2026, the goods economy appears less driven by a single macroeconomic narrative and more by a patchwork of sector‑specific forces. Business decisions around production, sourcing, and transportation remain cautious. Against this backdrop, rail volumes seem likely to respond unevenly, reflecting where freight‑intensive sectors and key lanes find firmer footing. While demand signals remain mixed, ongoing network investments and operational discipline leave railroads well equipped to adapt to volatility and capture incremental growth as conditions evolve.