KEY TAKEAWAY

Charging relatively higher rates to customers who have fewer competitive options than to customers with more competitive options is the most economically efficient way for railroads to cover their costs.

Most companies have two kinds of costs: fixed and variable. Fixed costs don’t change with the level of output, at least in the short term. Rent, for example, has to be paid even if the output is zero. Variable costs do vary with a company’s output. Labor and raw materials, for example, usually are variable costs — the higher the output, the greater these costs. To stay in business, companies must earn enough revenue to cover fixed costs and variable costs.

Railroads use differential pricing to cover their fixed and variable costs. Under differential pricing, railroads price their services so that they cover variable costs and realize different contributions to fixed costs from different customers. Put another way; differential pricing allows railroads to balance the desire of each customer to pay the lowest possible rate while requiring that the overall network earn enough to keep functioning now and in the future.

Businesses throughout the economy use differential pricing. For example, a car rental rate for the same car can vary dramatically from city to city and by the time of the year. A business traveler who buys a ticket at the last minute pays more than a vacationer who buys a ticket in advance. Matinees are cheaper than evening shows at movie theaters. And when it comes to utilities, large factories typically pay lower rates than homeowners.

Customer Benefits

Rail customers vary widely in their willingness to pay for rail service. When this is the case, differential pricing is the most efficient way for railroads to cover the full costs of providing safe, reliable service across their networks. Shippers benefit from differential pricing because lower prices for some shippers generate revenue that otherwise would have to be raised from those with the highest demand for rail service.

Hypothetical Example

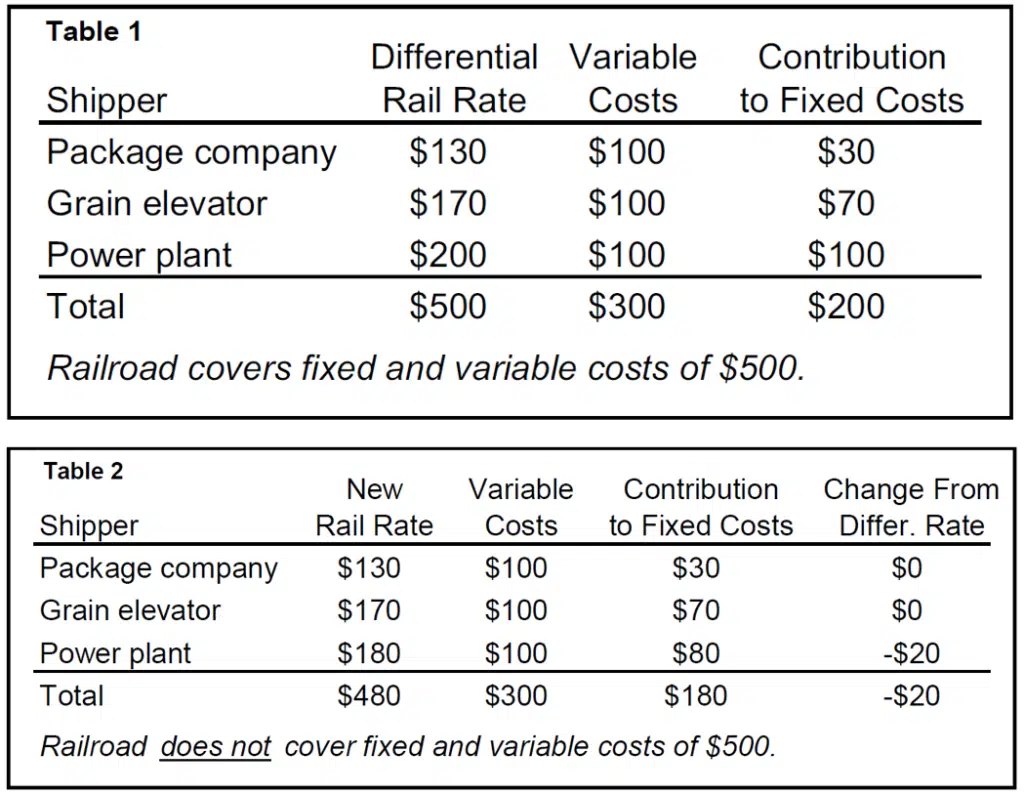

Imagine a railroad that has total fixed costs of $200 and serves three shippers: a package company, a grain elevator and a coal-fired power plant. For simplicity, assume the railroad’s variable costs to serve each shipper is $100.

Assume the package company will pay no more than $130 for rail service — anymore, and it will switch to truck. The grain elevator will pay no more than $170 — at a higher rate, it will lose its sales to grain grown elsewhere. The power plant is willing to pay more — $200 — for rail service.

The railroad prices differentially by charging the package company and the grain elevator less than the power plant (Table 1). The railroad covers its total costs, and each shipper makes a different contribution to the railroad’s fixed costs. Now, suppose a new regulation prohibits the railroad from charging a customer more than 180% of variable costs:

- The rates for the package company and grain elevator are not affected, but the rate for the power plant can’t exceed $180, which is 180% of variable costs. At this new rate, the power plant saves $20. The package company and grain elevator pay the same as before.

- At this new rate, though, the railroad’s revenue is only $480. This is $20 less than the railroad’s total costs of $500 (Table 2).

- The new regulation creates an artificial rate ceiling for the power plant, while the railroad loses revenue and no longer covers its total costs. Since companies must cover their costs to stay in business, the railroad must either increase its revenues or reduce its costs. But raising revenue is impossible. If the railroad raised its rates for the package company or the grain elevator, it would lose its business entirely, and its contribution to fixed costs would have to be made up by the remaining shipper, the power plant.

Therefore, the railroad would have to reduce its costs. Perhaps it would shed employees, reduce the frequency of service, or postpone buying equipment. This disinvestment would almost certainly lead to less timely, less reliable rail service. Eventually, rail service could be lost entirely. These outcomes are completely contrary to the needs of all the shippers, including the power plant the new regulation was supposed to help.

Reject Attacks on Differential Pricing

Unfortunately, new regulation is being considered that would improperly limit railroads’ use of differential pricing. If the current system of balanced regulation were overturned, there would no longer be a sufficient mix of high demand-high margin and low demand-low margin traffic for railroads to cover their costs.

The resulting earnings shortfall would limit railroads’ ability to fund the locomotives, freight cars, tracks, bridges, tunnels and other infrastructure and equipment they need to keep the U.S. freight rail network in world-best condition. Railroads’ ability to provide the safe, affordable and environmentally responsible service America needs would be severely compromised.