Key Takeaway: Freight railroads support a continuation of existing balanced regulatory policies. The STB must not implement wholesale changes that would compromise railroads’ ability to earn the revenue necessary to reinvest in the network and their employees to meet customer demand. STB policies encourage investment, not deter it.

The Surface Transportation Board (STB) is Congress-mandated to regulate freight railroads in the absence of effective competition. Despite the crucial role of railroads, constituting 40% of U.S. long-distance freight volume with a projected 30% growth by 2040, the STB is considering regulations that may impede investment.

Railroads, unlike other modes, fully cover infrastructure costs and privately invest billions each year into increasing safety, improving service and decreasing emissions. The STB should encourage freight rail investments by conducting cost-benefit analyses for proposed regulations, streamlining the rate case process, and developing a modern regulatory system based on free markets that acknowledge the capital-intensive nature of railroads and supports their continued evolution.

Railroads fiercely compete in the freight transportation market, securing their market share through competitive pricing and services. The STB oversees their operations as the economic regulator, ensuring reliability and affordability. Despite modest rate increases covering higher input costs, rail rates and input costs have consistently remained lower than many other economic goods and services over the past 40 years due to regulatory reforms.

The concept of “captive” shippers primarily served by a single railroad is driven by economic considerations rather than regulatory constraints, and access to alternative transportation modes provides additional options for shippers. Regulated rail mergers, with mitigation conditions like trackage rights, haven’t led to captive shippers but rather facilitated the benefits of single-line service, resulting in lower average rail rates.

While railroads generate modest profits, their significant investments contribute to a financially healthier industry. Rail volumes, excluding coal, closely align with economic sectors related to goods consumption and production, and the decline in rail coal shipments reflects shifts in energy markets.

Rail-to-rail Competition: Railroads are private companies that compete against each other for business. Rail customers often have connections to competing railroads, either directly or in conjunction with a short-haul truck movement. Some rail customers can also build (or credibly threaten to build) a new rail line to a competing railroad.

Other Modal Competition: Most rail customers can also ship via trucks, barges and/or pipelines. Trucks are freight rail’s largest competitor and they use infrastructure subsidized by the federal government, while railroads fully fund their infrastructure. This means the costs trucks offer shippers are artificially deflated. Many experts agree that trucks — not subject to the same type of regulatory scrutiny as railroads — will deploy a combination of autonomous, electric and platooning vehicles soon. These technological advancements could increase delivery times, improve on-time performance and significantly lower trucks’ labor and fuel costs — making trucks even fiercer competition for railroads.

Product Competition: Product competition refers to the widespread ability of a firm to substitute one product for another in its production process. For example, a utility can generate electricity from natural gas (which railroads do not generally carry) instead of coal (which railroads do carry). Similarly, a fertilizer manufacturer may substitute soda ash moved by rail with caustic soda transported by truck. Therefore, product options can also constrain transportation rates.

Geographic Competition: A rail customer can often get the same product from — or ship the same product to — a different geographic area. For example, taconite is a low-grade iron ore that, when combined with clay, creates pellets that can be transported to steel manufacturers and melted into steel. This clay is available from Wyoming mines, served by one railroad, and from Minnesota mines, served by another. Iron ore producers can pit one railroad against the other for clay deliveries. This is another type of real-world competition, called geographic competition, that also constrains rail rates.

Shipper Competition: Shippers can also generate competition between railroads before they build a manufacturing plant. They do this by negotiating favorable contracts when evaluating potential plant locations. Over the long term, shippers can locate or relocate plants on the lines of different railroads. Shippers often make the business decision to locate their facilities at sites with access to only one railroad. This means other factors, aside from having multiple rail service options, can drive the decision to locate a shipper’s facility.

Future Competition: Technological, regulatory or structural changes over time will give shippers leverage over railroads. For example, fracking made natural gas much more abundant and less expensive. In turn, natural gas delivered via pipeline becomes the preferred fuel source for electricity generation, instead of coal delivered by trains. This marketplace disruption constrains the rates railroads can charge for delivering coal to utilities.

Despite intense competition, railroads consistently invest in infrastructure, equipment, operations, and technology. Regulations such as forced access or FORR may impede rail investment, emphasizing the need for the STB to adopt a free-market-aligned regulatory framework to encourage ongoing investment.

Policy Position: The freight rail industry opposes forced switching because it would hinder U.S. commerce, increase shipping costs, compromise rail safety and disrupt the supply chain. Passenger railroads, environmental advocates, labor unions and other transportation organizations agree it is important to maintain a competitive and efficient rail system without unnecessary government intervention.

The STB recently withdrew a comprehensive switching proposal and is now exploring a new service-based approach. Advocates of forced switching aim for below-market rate levels for their traffic, potentially impacting the fluidity of the network and other customers. This form of backdoor rate regulation could hinder U.S. commerce and increase consumer goods costs.

Railroads intentionally concentrate and route traffic to optimize operational efficiencies and network fluidity. Their routing practices, developed over decades, benefit the entire customer base. Forced switching, requiring extensive operations, could compromise the efficiency of the nation’s rail network. Railroads actively compete with trucks, barges, and other market forces, consistently investing in infrastructure, equipment, training, operations, and technology to enhance their networks, increase safety and better serve customers.

Increased switching poses safety risks for workers and may lead to higher emissions. Potential delays in freight operations could impact passenger rail services and commuters. A less efficient railroad, influenced by increased switching, becomes less competitive, causing delays in the transportation of goods across the supply chain.

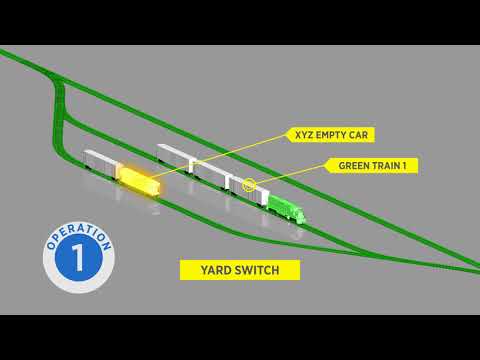

Forced switching explainer video.

Policy Position: The STB should withdraw its FORR proposal because it would harm small shippers and railroads. No other federal government agency reviews regulated rates in this manner.

The STB introduced the Final Offer Rate Review (FORR) proposal on September 11, 2019, aiming to alter the process for rail customers contesting the reasonableness of individual rail rates. Departing significantly from existing statutory processes, FORR replaces careful rate deliberation with a single binary decision. Unlike the previous approach that involved a full hearing and established methodologies, FORR allows complainants to propose rates, and the STB can choose a rate solely based on perceived relative reasonableness.

The proposal raises concerns about rail customers effectively setting their rates independent of market conditions. In contrast to the longstanding practice of careful deliberation, FORR lacks standards for determining rate reasonableness and relies on a final offer arbitration model more suited to salary negotiations in professional baseball than to evaluating complex railroad economics.

While FORR is presented as a quick solution for small rate challenges, it lacks exclusive application to small shippers. The $4 million relief cap allows larger shippers to pursue multiple FORR cases concurrently, potentially disadvantaging smaller entities. This approach, devoid of market-based outcomes and uniform standards, may lead to below-market rates, jeopardizing the industry’s essential revenue generation for investing in the privately financed rail network and maintaining safety, efficiency, and reliability.

Policy Position: The freight rail industry opposes reauthorizing the STB because it would interfere with private contracts and expand government control, which would make it harder for railroads to make the private network investments America relies on.

The STB recognizes reauthorization is not needed. In fact, STB Chairman Martin Oberman has said: “While the problems facing the rail industry today are significant, in my view, the Board can use its existing authority to mitigate those problems in a meaningful way.” The Freight Rail Shipping Fair Market Act would provide the STB with overreaching authority to place unnecessary regulations on freight railroads. Turning the clock back more than 40 years and returning to an unbalanced regulatory framework would put our nation’s rail advantage at risk and ultimately diminish the quality of rail service and undermine the efficiency of supply chains.

On May 12, 2022, STB Chairman, Martin Oberman, testified before the House of Representatives Committee on Transportation & Infrastructure Subcommittee on Railroads, Pipelines, & Hazardous Materials and explained that expanding the Board’s regulatory oversight would not help the labor and supply chain challenges freight railroads are working hard to solve. The proposal lacks justification, eliminates exemptions and increases costs. It interferes with private contractual relationships, substituting them with government mandates, and expands government control by extending jurisdiction over private railcar owners.

The Staggers Act transformed railroads.

By the 1970s, decades of increasingly stringent government regulation — together with intense competition from other modes of transportation — had brought the U.S. freight railroad industry to near ruin.

Thanks to Congress passing The Staggers Act on October 14, 1980, which instituted a system of balanced regulation in the rail industry, freight railroads invested around $780 billion, fostering a world-class national network and creating the safest way to move goods over land.

Source: AAR / “Rates” is inflation-adjusted revenue per ton-mile. “Volume” is ton-miles. “Productivity” is revenue ton-miles per constant dollar operating expense. “Revenue” is operating revenue in 2022 $. Download Chart

In the 1970s, major railroads in the Northeast, including the Penn Central, and several Midwestern railroads went bankrupt, constituting over 21% of the nation’s rail mileage. The rail industry’s return on investment during 1970-1979 never surpassed 2.9%, averaging 2%, considerably lower than a child’s savings account.

Railroads’ diminishing average rate of return over decades, dropping from 4.1% in the 1940s to 2.8% in the 1960s, culminated in a reduced intercity freight share to 35% by 1978. Inadequate funds led to unsafe track conditions, with over 47,000 miles operated at reduced speeds by 1976.

Faced with an untenable status quo, Congress had a choice between nationalization or balanced regulation. Opting for balance, Congress enacted the Staggers Rail Act of 1980, recognizing the need for a common-sense regulatory system for privately-owned freight railroads to manage assets and price services competitively.

The Staggers Rail Act eliminated many of the most damaging regulations, allowing railroads to take a smart, customer-focused and market-based approach to railroading. Under Staggers, regulators retained authority (which they still have today) to protect shippers and consumers against unreasonable railroad conduct and unreasonable railroad pricing.

Staggers allowed railroads to set prices based on market demand and operate efficiently. It facilitated flexible business arrangements through confidential contracts, streamlined procedures for selling rail lines, and recognized railroads’ need for adequate revenue. The legislation empowered regulators to exempt specific rail traffic categories from regulation, ensuring intervention only where necessary to protect shippers from potential abuses of market power. For instance, freight easily transportable by railroads’ trucking competitors could be exempted, aligning with the act’s goal of balanced and sensible regulation.

Since 1980, the Staggers Rail Act has revolutionized railroading with a customer-focused, market-based approach, benefiting railroads and the economy. Productivity soared by over 150%, accompanied by a 40% reduction in average rates, allowing increased freight movement at the same cost as 40 years ago. The last has been the decade for safest ever and short line and regional railroads, spanning 45,000 route miles across 49 states, highlight the Act’s positive impact on preserving rail service and jobs.